The "new silk roads": an evaluation essay

(3/4): China as a global player in globalization

China's accelerated development since the Deng reforms in 1978 has, to a large extent, benefited from its policy of international openness. This has continued to deepen. Almost nil at the time of Mao, China's share in world exports reached 13.3% in 2018 (after a peak of 14.1% in 2015) and 10.7% in imports. China is now the world's largest exporter and second largest importer.

This acceleration is partly due to the massive entry of foreign companies. Non-existent until 1992, FDI inflows reached $136 billion in 2017, representing on average 8% of the world total of FDI from 1992 to 2017. Incoming investments in imported component manufacturing [1] have played a major role in the growth of Chinese exports: in the early 2000s, 55% of Chinese exports were made by subsidiaries of foreign companies and, since then, this share has declined steadily to 43% in 2017.

In 2013 China becomes a global investor

2013 can be considered as the year of China's affirmation as an actor of globalization and no longer as a mere receptacle. In 2015, FDI outflows are more important than inflows. Since 2013, it has been developing on a large scale its direct investments abroad, long-term loans and acquisitions of equity portfolios.

It has thus increased from less than one percent of global outward direct investment over the period 2004-2007 to more than ten percent over the period 2014-2017. According to Heritage[2], the most of its investments for the period 2005-2017 are concentrated on merger and acquisition operations: for $829 billion compared to $260 billion in new investments (Greenfield Investment). Europe is the prime destination with $305 billion in M&A, followed by the United States with $158 billion, compared to $13 billion and $18 billion respectively in new investment. More accurately, the acquisition of Western companies is oriented on the one hand towards traditional sectors linked to tourism and trade (hotels, restaurants and food, road, sea and air transport), but also towards energy and high-tech companies, which is a growing concern both in terms of security and competition. In addition to these direct investments, portfolio investments[3], which are more like equity investments than new investments, represent 40% in addition to direct investments over the period 2013-2107. In contrast, direct investment in developing countries or in Belt and Road Initiative (BRI) countries is very low, as companies likely to be acquired by Chinese investors are rare and the risks associated with such investments are very difficult to measure.

BRI infrastructure and debt

Xi Jinping has set the goal of completing its project until 2049, the 100th anniversary of the founding of the People's Republic of China. It is impossible to accurately measure the progress made in the implementation of its project, as China does not publish an official list of BRI-ranked projects. In addition, some projects - such as the Pakistani corridor or the Indonesian TGV - were undertaken by China well before BRI' announcement in 2013.

In addition, the few official disclosures are contradictory[4]. This lack of coherence and transparency has led to many survey initiatives, including the publications of the RWR Advisory Group for BRI-related loans. According to RWR, the amount of loans granted annually by Chinese banks, which had been 150 billion dollars in 2014 and 2015, fell below the 100 billion threshold in 2017 and 2018.

Direct investment versus loans

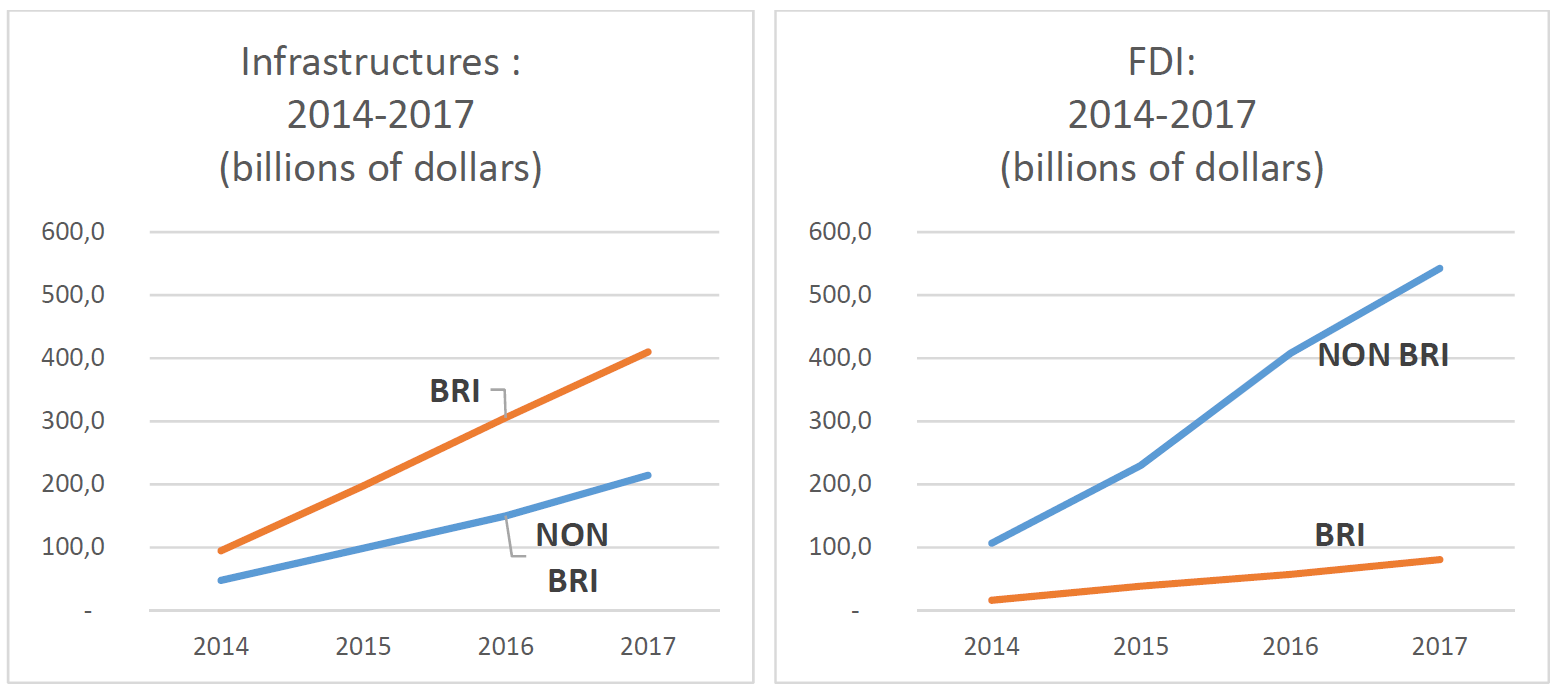

According to Mofcom, direct investment in BRI participating countries is very low, at $18 billion compared to $138 billion for non-BRI countries. There are relatively few company takeovers. There are several reasons for this: the large companies in these countries are few in number, the data concerning them are generally not very transparent, and these companies are often protected by their governments. On the other hand, China offers these countries very large and fast-growing loans to finance the development of their infrastructure.

Alongside these loans, Chinese companies have a strong presence in emerging countries, where they have carried out nearly 80% of their construction contracts, representing a total of $1.3 trillion between 2005 and 2017. East Asia comes first, followed by West Asia, then South-East Asia, the Maghreb and finally South Asia (Pakistan), quite far behind is Latin America. Developed countries are virtually non-existent in these programs.

According to Mofcom, the average annual construction by Chinese companies in the 80 BRI countries rose from $58 billion in 2009-2013 to $85 billion in 2014-2017, a 50% increase. The largest increases occurred in South-East Asia and the Middle East, slightly less in South Asia and little in Central Asia.

(annual average in billon USD)

|

2009/13 |

2014/17 |

|

| World | 97.5 | 156 |

| 80 BRI countries | 58 | 85 |

| BRI Africa | 13.0 | 17.7 |

| BRI Asia | 41.4 | 63.9 |

| South Asia | 10.5 | 13.5 |

| Central Asia | 3.4 | 4.6 |

| South East Asia | 14.5 | 27.1 |

| Middle East | 12.1 | 18.7 |

| BRI Europe | 2.3 | 3.4 |

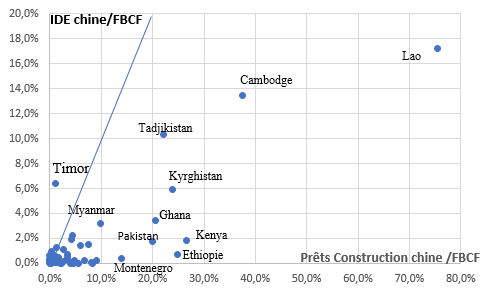

By relating Chinese credits and FDI to the Gross Fixed Capital Formation of BRI member countries, it appears that the share of credits is higher (with the exception of Timor, the countries are on the right-hand side of the diagonal) than that of FDI. On the other hand, China's participation in these two aspects is very strong among its immediate neighbours (Cambodia, Laos, Tajikistan, Kyrgyz Republic). Outside this area, some African countries (Ghana, Ethiopia, Kenya and Mozambique) are also prime targets for the Chinese, while Pakistan appears to be of major interest to China, probably due to geostrategic considerations.

Central role of Chinese banks and faded role of multilateral banks initiated by China

The Chinese banking system that supports BRI consists of four types of institutions:

The "policy banks", China Development Bank and Exim Bank, on the one hand, and the four major Chinese commercial banks[5] that finance 97% of China's international lending operations. The rest is taken care of by the multinational banks created by China. Thus, of the $292 billion, $134 billion comes from Exim Bank and China Development Bank, $150 billion from China's public commercial banks. Finally, two multilateral banks, the Asian Infrastructure Investment Bank (AIIB) and the New Development Bank (NDB)[6], each contribute only $2 billion (Financial Times, 11 May 2017).

Two years after the launch of the BRI, China has announced the creation of the Asian Infrastructure Investment Bank (AIIB). This initiative, criticized by Washington for wanting to undermine the governance of international financial institutions, was welcomed by 57 countries, including European countries, which contribute to its capital, which amounts to $100 billion. China would hold 43% of the votes. The rise of this new multilateral bank is slower than expected. Established in January 2017, it approved $4.4 billion worth of projects (in May 2018), eight times less than the Asian Development Bank. The other Chinese banks, mentioned above, invested $177 billion out of a total of $186 billion at the end of 2016. According to the China Banking Association, cited by Caixin, the share of AIIB and the New Development Bank (NDB) accounted for 1.4% of an outstanding amount of 292 billion (or 100 billion more) in the BRI countries. In January 2018, at the Asian Financial Forum in Hong Kong, the Central Business District (CBD) reported that it had committed 110 billion by the end of 2017 (Asian Nikkei Review, 15 January 2018). The slow start of the AIIB's activities is probably due to the fact that this bank must comply with the rules of governance and transparency in use by major international banking institutions, which is not the case for banks with purely Chinese capital. In this field too, Chinese practices will have to change.

As a conclusion, if we take a look at China's international activity, we are first struck by the speed with which it has been deployed to establish China as a major player in the global economy. The Silk Roads project, which is a unique and unrivalled project, but which corresponds to very real needs[7], appears above all as a means of gradually structuring the Chinese vision of globalization, which combines China's long-term economic and strategic interest. It remains to be seen whether such a project is realistic, as discussed in blog 4.

[1] Guillaume Gaulier, Françoise Lemoine, Deniz Ünal-Kesenc. 2005. China’s Integration in East Asia: Production Sharing, FDI & High-Tech Trade. CEPII working Paper 2005 n°9.

[2] According to Mofcom, two thirds of these flows go to Hong Kong and tax havens, Cayman Islands, Virgin Islands, some of which are being sent to other countries. Since 2005, Heritage has built a database using press information validated by surveys. It collects statements of projects worth more than $100 million from 200 companies, whereas, according to Mofcom, nearly ten thousand have invested abroad. This leads to underestimating China's presence abroad (in number) and by identifying commitments and not achievements (which are rarely reported), it overestimates the amounts invested.

[3] The IMF's distinction for balance of payments data is to classify equity investments above 10% as direct investment and those below as portfolio investment.

[4] In March 2017, the Director of the National Development Reform Commission (NDRC) announced that China's cumulative investment under the BRI had been $50 billion since 2013, and, at the same time, the spokesman for Mofcom (Ministry of Foreign Trade) reported that the amount of contracts signed had reached $304.9 billion since 2013.

[5] ICBC (Industrial and Commercial Bank of China), Bank of China, China Construction Bank and Agricultural Bank of China.

[6] Bank of Brics.

[7] Asian Development Bank. 2017. Meeting Asia's Infrastructure Needs.

Jean-Raphaël Chaponnière is an associate researcher at Asia Centre and the Asia21

|

Retrouvez plus d'information sur le blog du CEPII. © CEPII, Reproduction strictement interdite. Le blog du CEPII, ISSN: 2270-2571 |

|||

|