The world trading system is probably facing its most serious crisis since World War II. With significant disagreements about rules and their interpretation, multiplying unilateral measures, and the paralysis of appointment of members at the Appellate Body of its Dispute Settlement Body (DSB), the World Trade Organization (WTO) finds itself in a critical situation, where its existence, or at least its relevance, seems called into question. This threat should be taken very seriously. While the benefits of a rules-based trading system are widely recognized, it should be emphasized that the capacity of the present system to make commitments clear and enforceable is unprecedented. Rather, historical precedents were in many cases characterized by uncertainty, unreliability, and in many cases unfairness, with widespread political interference. Falling back to disorganized and unpredictable trade relationships would be especially costly at a time where international economic relationships are as close as ever, with global value chains ubiquitous. Still, the only guarantee against such a leap backward is the willingness of the organization’s members to find a way to adapt it to today’s challenges. Sébastien Jean >>> |

- Deep PTAs, Global Value Chains and Migration

Gianluca Orefice - Why the WTO needs reform

Sébastien Jean - Fixing the euro needs to go beyond economics

Anne-Laure Delatte

- Uncertainty Shocks and Firm Creation: Search and Monitoring in the Credit Market

Thomas Brand, Marlène Isoré, Fabien Tripier - Sovereign Risk and Asset Market Dynamics in the Euro Area

Erica Perego

- Journal of Comparative Economics

Multi-destination firms and the impact of exchange-rate risk on trade

Jérôme Héricourt, Clément Nedoncelle - Journal of International Economics

The international elasticity puzzle is worse than you think

Lionel Fontagné, Philippe Martin, Gianluca Orefice - Journal of International Economics

Does Exporting Improve Matching? Evidence from French Employer-Employees data

Matilde Bombardini, Gianluca Orefice, Maria Tito - International Economics

N° 156 - Q4 2018 - Journal of Economics and Management Strategy

Exporting firms and retail internationalization: Evidence from France.

Angela Cheptea, Charlotte Emlinger, Karine Latouche

Immigration in OECD Countries - 8th Annual International Conference

December 10 - 11, 2018

Theories and Methods in Macroeconomics (T2M) - 23rd Conference

March 22 - 23, 2019

19th Doctoral Meetings in International Trade and International Finance

June 27 - 28, 2019

Deep PTAs, Global Value Chains and Migration Preferential trade agreements (PTAs) can be used by signatory countries to manage international migration flows and participation in global value chain. The inclusion of an additional provision in PTAs stimulates the bilateral fragmentation of production by 1 percent, while PTAs that facilitate visa and asylum administrative procedures stimulate bilateral migration by up to 34 percent. Gianluca Orefice >>> |

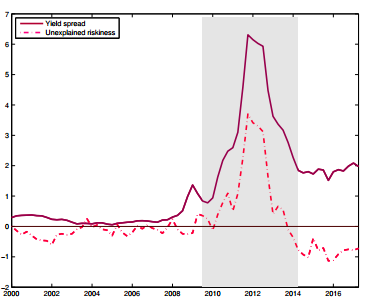

The sovereign risk shock This paper studies the behavior of euro area asset market co-movements during the period 2010-2014, through the lens of a DSGE model. The simulation results indicate that the sovereign risk shock explains 50% of the increase in sovereign and loandeposit spreads, and 8% of the decrease in global output during the sovereign debt crisis. Erica Perego >>> |

CEPII is a member of the European Network for Economic and Fiscal Policy Research, a unique collaboration between policy-oriented university and non-university research institutes that are contributing their scientific expertise to the debate over the EU’s future design. Read the November issue of the EconPol Europe Newletter. |

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli