In the wake of the Brexit referendum, the uncertainty created by the vote emerged as a serious threat to the UK’s economy, as illustrated by the statement of Mark Carney. More than three years later, Brexit is still not settled, but the uncertainty remains. With the benefit of hindsight, it is now possible to estimate the cost to the British economy of this long period of uncertainty. I show that this cost is large: around half a point of economic growth per year since 2016, which is equivalent to a loss of £16 billion per year for the UK’s economy. This estimation is based on the following three-step procedure.

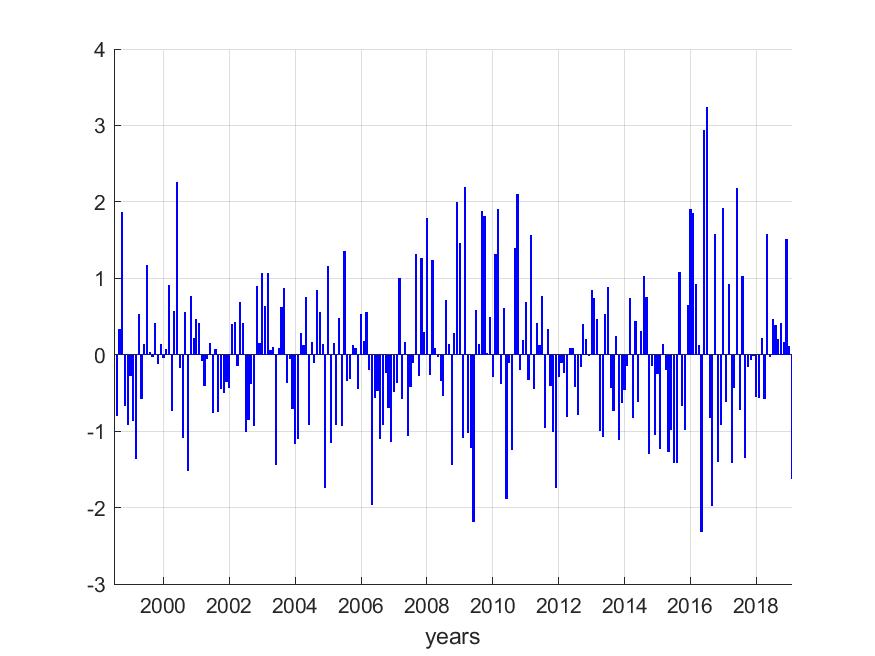

First, the level of political uncertainty must be measured. This can be done through the media: economists Scott R. Baker, Nick Bloom and Steven J. Davis recently proposed a new way to measure political uncertainty (http://www.policyuncertainty.com/). Their idea is quite simple: counting in the newspapers the proportion of articles published that mention political uncertainty; that is, that contain both these three terms "Economy" and "Politics" and "Uncertainty". This method can be applied to a large number of countries, for very different periods and even allows for day-to-day monitoring. Figure 1 shows the Economic Policy Uncertainty in the United Kingdom since 1998. As expected, the index skyrockets after 2016 with the outcome of the referendum on the Brexit.

.jpeg)

Second, the effect of this uncertainty on the economy must be measured. Measuring an effect means being able to establish a causal relationship between uncertainty and the economy. However, the economic situation naturally also has an effect on uncertainty: a deterioration in the economic environment is often accompanied by an increase in uncertainty about the economic policy that will be pursued in response. Faced with this interdependence of economic phenomena, different strategies can be used to disentangle the causal relationships at stake.

Ideally, changes in uncertainty should be strictly independent of the economic situation. Since such changes are rare, econometric methods[1] make it possible to identify these types of events based on the observation that they instantly affect certain financial variables, such as the exchange rate or stock prices, but not production and investment behaviours, which are more inert by nature and therefore react with a delay of at least one month. In short, we exploit the differences in reaction speed between the different actors in the economy. Figure 2 shows the identified changes in uncertainty for the U.K., labelled uncertainty shocks, which reach their highest values in 2016 with the outcome of the referendum on the Brexit.

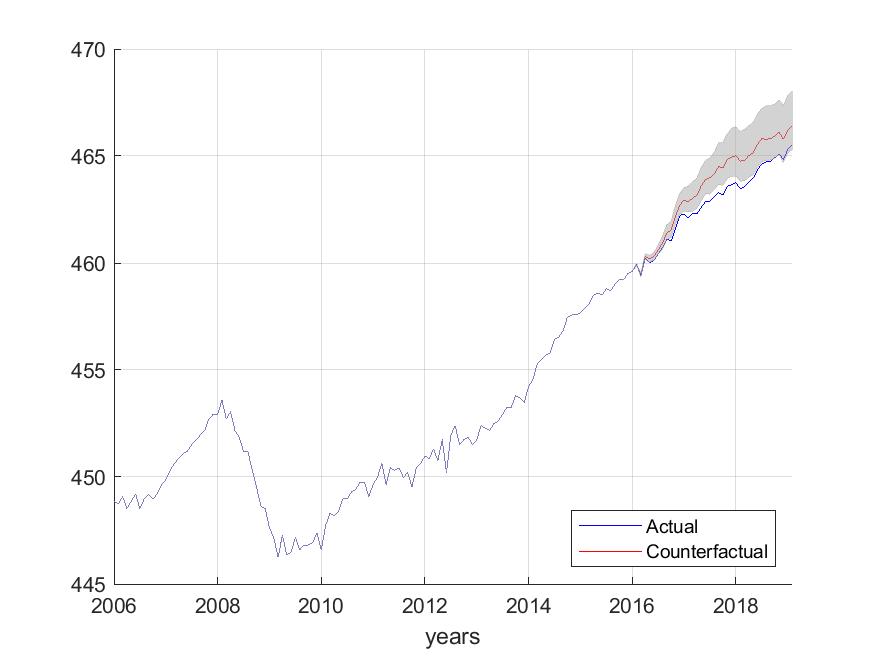

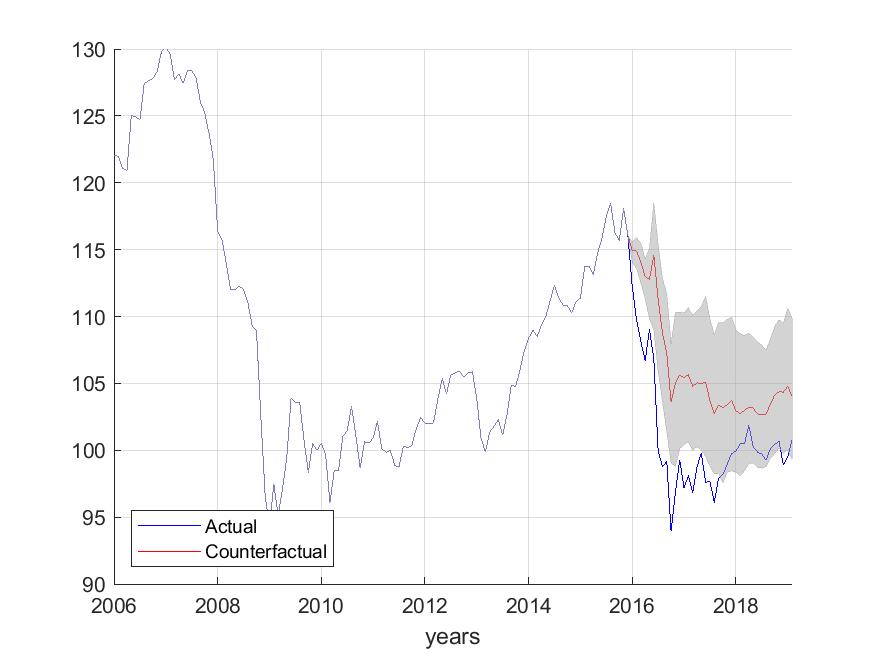

Third, a counterfactual experiment should then be conducted: quantifying the effects of uncertainty by comparing the trajectory with the one it would have followed in the absence of these changes in uncertainty. What lessons can be learned about Brexit? Figures 3 to 5 compare historical data (in blue) and what would have happened without uncertainty policy shocks after January 2016 (in red).

The British economy grew at a rate of 1.9% per year between 2016 and 2018. In the absence of these changes in uncertainty, growth would have been higher, at around 2.3% per year, representing a loss of 0.4 percentage points of annual growth over these three years (see Figure 3). In terms of gross domestic product (GDP), this represents an average loss of -0.8% per year, the lowest value being -1.3% (see Figure 4). Given that Britain's average annual GDP is around £2 trillion, the economic cost of uncertainty has risen to £16 billion per year since 2016, or £307 million per week; roughly what Boris Johnson's election buses promised to recover from the European Union through Brexit (£350 million). When it comes to the Livre Sterling, the depreciation of the currency would have been half-lower without the uncertainty shocks in 2016 (see Figure 5).

These figures indicate that the economic cost of uncertainty is certainly significant, but does not mean that it is likely to plunge the British economy into a deep recession, as it did between 2007 and 2009 when its annual growth rate fell by several points from +3% to -6%. These orders of magnitude (1% of GDP, half a point of growth) invite us to avoid any catastrophism in these situations of political change - the Brexit, but also the election of Donald Trump who was also supposed to push the American economy into chaos. However, even if political uncertainty does not trigger severe recessions, its impact on the economy is significant enough for policy-makers to take it into account by implementing policies to support activity to mitigate its economic cost.

.jpeg)

Further Readings

Bank of England (2019), Monetary Policy Report, November 2019.

Baker, S. R., N. Bloom, and S. J. Davis (2016a). Measuring economic policy uncertainty. The Quarterly Journal of Economics 131 (4), 1593-1636.

Baker, S. R., N. Bloom, and S. J. Davis (2016b). Policy uncertainty: trying to estimate the uncertainty impact of Brexit. Presentation, September 2.

Bloom, N., Bunn, P., Chen, S., Mizen, P., Smietanka, P., Thwaites, G., & Young, G. (2018). Brexit and uncertainty: insights from the Decision Maker Panel. Fiscal Studies, 39(4), 555-580.

Born, B., G. J. Müller, M. Schularick, and P. Sedlacek (2019). The costs of economic nationalism: evidence from the Brexit experiment, Economic Journal forthcoming.

Born, B., G. J. Müller, M. Schularick, and P. Sedlacek (2019). ´£350 million a week: The output cost of the Brexit vote, Vox Column, https://voxeu.org/article/300-million-week-output-cost-brexit-vote

Denis, M. S. and P. Kannan (2013). The impact of uncertainty shocks on the UK economy. International Monetary Fund Working Paper 13-66.

Mumtaz, H. (2016). The evolving transmission of uncertainty shocks in the United Kingdom. Econometrics 4 (1), 16.

Redl, C. (2017). The impact of uncertainty shocks in the United Kingdom, mimeo.

Tripier, F. (2019). « Combien l’incertitude créée par le Brexit a coûté à l’économie britannique ? », Le Monde, https://www.lemonde.fr/idees/article/2019/06/26/combien-l-incertitude-creee-par-le-brexit-a-coute-a-l-economie-britannique_5481798_3232.html#

Data

Real Gross Domestic Product (gdp): https://www.ons.gov.uk/economy/grossdomesticproductgdp/datasets/gdpmonthlyestimateuktimeseriesdataset

Economic Policy Uncertainty (poluncertainty): http://www.policyuncertainty.com/uk_monthly.html

Consumer Price Index of All Items in the United Kingdom (prices): https://fred.stlouisfed.org/series/GBRCPIALLMINMEI

Real Broad Effective Exchange Rate for United Kingdom (reer): https://fred.stlouisfed.org/series/RBGBBIS

Monetary policy rate using shadow rate since 2009 (policyrate): https://sites.google.com/view/jingcynthiawu/shadow-rates

[1] For this report, I use a Structural Vector Auto-Regressive (SVAR) model for the following set of six variables ordered as follows: y = [gdp, prices, reer, poluncertainty, policyrate], see the Data section in the appendix for the definition of series. The SVAR is estimated with 6 lags. The identification scheme of uncertainty shocks is based on the following sign restrictions: uncertainty shocks increases economic political uncertainty and decreases the real effective exchange rate at the impact while leaving unchanged the real GDP, the level of prices, and the monetary policy rate. Figures show the confidence intervals at the [16 − 84] percentage.

|

Retrouvez plus d'information sur le blog du CEPII. © CEPII, Reproduction strictement interdite. Le blog du CEPII, ISSN: 2270-2571 |

|||

|