Is the exchange rate – oil price nexus stable over time?

It is a widely accepted view that many commodity-exporting countries have commodity currencies, in that movements in real commodity prices can explain fluctuations in their real exchange rates.

By Valérie Mignon, Jean-Pierre Allegret, Cécile Couharde, Tovonony Razafindrabe

Among those commodities, oil has been identified as a potential driver of currencies as movements in the real price of oil can also have significant influence on oil producers' real exchange rates.

On a theoretical level, two main arguments have been put forward to explain the existence of oil currencies. First, higher oil prices may bring about an appreciation of real exchange rates through an improvement in terms of trade which in turn increases revenues from the oil exports. Second, exchange rates of oil countries can also experience a ‘wealth effect’ through the specific impact of oil price changes on international portfolio decisions and trade balances: oil-exporting countries can encounter a wealth transfer driven by the improvement of their net foreign asset position if the oil price rises.

The empirical literature has, however, provided mixed support for the assumed relationship between the oil price and real exchange rates of oil-producing countries. This result could stem from the empirical approach used to estimate the relationship between oil prices and real exchange rates. Indeed, the literature investigating the macroeconomic effects of oil price shocks has recently highlighted the importance of identifying the sources of those shocks. In particular, there is some evidence that the sources of changes in oil prices vary over time.

Against this background, we examine in a recent CEPII Working Paper [1] oil shocks’ transmission mechanisms to real exchange rates over time and the driving forces behind the observed time variation. Accordingly, we distinguish between three sources of oil price shocks: exogenous disruptions in oil supply, oil demand shocks driven by global economic activity, and oil market specific demand shocks caused by speculative or precautionary motives. We explore the time-varying dimension of the relationship between real exchange rates and oil prices by relying on a time-varying parameter VAR (henceforth TVP-VAR) specification. The main advantage of the TVP-VAR is to allow oil shock effects and the oil price transmission to real exchange rates to vary over time; a property which is essential to capture the time-changing effects of shocks.

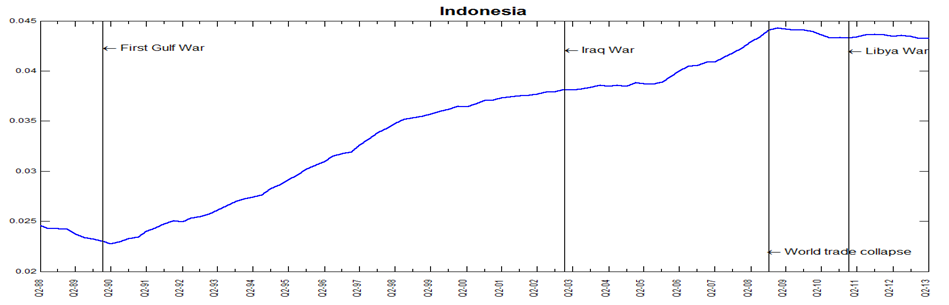

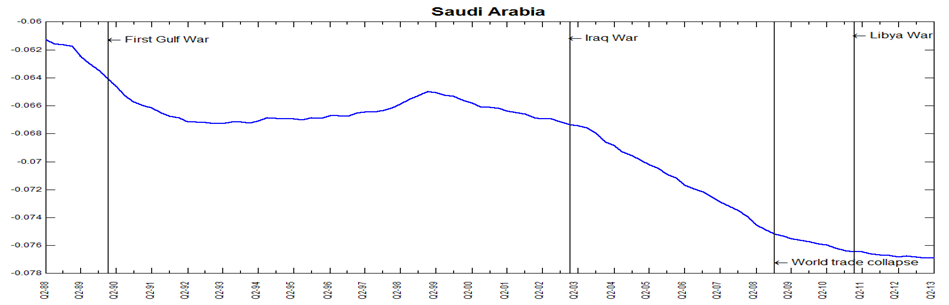

We consider a sample of five oil exporters, namely Canada, Indonesia, Norway, Saudi Arabia, and the United Kingdom, over the 1988Q1-2013Q2 period. We start by investigating whether the response of real exchange rates to unexpected oil price shocks whatever their underlying source, has changed over time. Our interest is to detect possible structural shifts in oil economies and to have a first insight regarding the potential of the time-varying oil-currency property for our selected oil-exporting countries. Figure 1 reports the dynamics of the contemporaneous relationship between the real effective exchange rate and the real oil price.

Except for Saudi Arabia, positive changes in the world oil price trigger a contemporaneous appreciation of the real exchange rate. As exports are highly concentrated in Saudi Arabia, the positive relationship between the oil price and real exchange rates is not necessarily explained by the prominence of the petroleum sector and dampened effects can indeed be at stake. For example, for long-standing US dollar peggers such as Saudi Arabia, studies evidence that this anchor seems to have delivered the expected benefits of this exchange rate regime, contributing to low inflation over the long term. This can then explain the remarkable stability of the real exchange rate and its observed resilience to oil price fluctuations across the considered time period. Except for the Saudi riyal, an increase in the oil price is associated with a real appreciation of the effective exchange rate. The intensity of this co-movement however differs across currencies, being more intense for Canada, Indonesia and Norway, and less pronounced for the United Kingdom.

But, the most striking feature is the significant time variation in the contemporaneous responses of real exchange rates to oil price movements. More precisely, looking at Figure 1 we can identify at least two periods in the magnitude of real exchange rates' responses to an increase in the oil price. The first spans from the beginning of our sample period to the world trade collapse (2008) where the transmission of oil prices to real exchange rates clearly varies over time, significantly increasing and reaching a peak in some countries (Canada, Indonesia, Norway) or decreasing in the United Kingdom. This period coincides with the increase in the non-OECD’s oil consumption share in the world consumption, stemming mainly from a rise in China’s and India’s oil consumption. The second period begins after the world trade collapse, where the sensibility of real exchange rates is broadly maintained at a constant level. Differences in the adjustment pattern between those two periods and within each period underline the fact that the relationship between the oil price and real exchange rates is subject to change over time, suggesting that time-varying effects are a key issue when analyzing oil currencies. Moreover, as reactions of real exchange rates to the real oil price are more fluctuating during the first period which coincides with the increase in the non-OECD’s oil consumption, we should therefore expect to obtain more significant impulse responses when increases in oil prices are driven by a growing global demand. This confirms the relevance to investigate the origins of this time-varying dimension of the relationship between real exchange rates and the oil price, by distinguishing the underlying sources of oil price shocks.

Specifically, we show in our analysis [1] that while oil supply shocks play a small role in explaining the relationship between oil prices and real exchange rates, oil demand shocks are shown to have a sizeable effect, over the 1988-2003 period. Indeed, those shocks cause time-varying relationships between real exchange rates and oil prices which, however, tend to offset each other. However, the appreciation of real exchanges rates following a demand-driven rise in oil prices is only confined to some countries, suggesting that in addition to endogenous structural changes in the oil market, both economic policies and structural characteristics matter as driving forces behind the adjustment of real exchanges rates to oil price shocks.

[1] Allegret Jean-Pierre, Couharde Cécile, Mignon Valérie, Razafindrabe Tovonony (2015), “Oil currencies in the face of oil shocks: What can be learned from time-varying specifications?”, Working Paper CEPII.

On a theoretical level, two main arguments have been put forward to explain the existence of oil currencies. First, higher oil prices may bring about an appreciation of real exchange rates through an improvement in terms of trade which in turn increases revenues from the oil exports. Second, exchange rates of oil countries can also experience a ‘wealth effect’ through the specific impact of oil price changes on international portfolio decisions and trade balances: oil-exporting countries can encounter a wealth transfer driven by the improvement of their net foreign asset position if the oil price rises.

The empirical literature has, however, provided mixed support for the assumed relationship between the oil price and real exchange rates of oil-producing countries. This result could stem from the empirical approach used to estimate the relationship between oil prices and real exchange rates. Indeed, the literature investigating the macroeconomic effects of oil price shocks has recently highlighted the importance of identifying the sources of those shocks. In particular, there is some evidence that the sources of changes in oil prices vary over time.

Against this background, we examine in a recent CEPII Working Paper [1] oil shocks’ transmission mechanisms to real exchange rates over time and the driving forces behind the observed time variation. Accordingly, we distinguish between three sources of oil price shocks: exogenous disruptions in oil supply, oil demand shocks driven by global economic activity, and oil market specific demand shocks caused by speculative or precautionary motives. We explore the time-varying dimension of the relationship between real exchange rates and oil prices by relying on a time-varying parameter VAR (henceforth TVP-VAR) specification. The main advantage of the TVP-VAR is to allow oil shock effects and the oil price transmission to real exchange rates to vary over time; a property which is essential to capture the time-changing effects of shocks.

We consider a sample of five oil exporters, namely Canada, Indonesia, Norway, Saudi Arabia, and the United Kingdom, over the 1988Q1-2013Q2 period. We start by investigating whether the response of real exchange rates to unexpected oil price shocks whatever their underlying source, has changed over time. Our interest is to detect possible structural shifts in oil economies and to have a first insight regarding the potential of the time-varying oil-currency property for our selected oil-exporting countries. Figure 1 reports the dynamics of the contemporaneous relationship between the real effective exchange rate and the real oil price.

|

Figure 1: Contemporaneous link between real effective exchange rates and real oil price |

.png) .png) .png)   |

|

Note: this figure displays the dynamics of the contemporaneous relationship between the real effective exchange rate and the real oil price for each country.

|

Except for Saudi Arabia, positive changes in the world oil price trigger a contemporaneous appreciation of the real exchange rate. As exports are highly concentrated in Saudi Arabia, the positive relationship between the oil price and real exchange rates is not necessarily explained by the prominence of the petroleum sector and dampened effects can indeed be at stake. For example, for long-standing US dollar peggers such as Saudi Arabia, studies evidence that this anchor seems to have delivered the expected benefits of this exchange rate regime, contributing to low inflation over the long term. This can then explain the remarkable stability of the real exchange rate and its observed resilience to oil price fluctuations across the considered time period. Except for the Saudi riyal, an increase in the oil price is associated with a real appreciation of the effective exchange rate. The intensity of this co-movement however differs across currencies, being more intense for Canada, Indonesia and Norway, and less pronounced for the United Kingdom.

But, the most striking feature is the significant time variation in the contemporaneous responses of real exchange rates to oil price movements. More precisely, looking at Figure 1 we can identify at least two periods in the magnitude of real exchange rates' responses to an increase in the oil price. The first spans from the beginning of our sample period to the world trade collapse (2008) where the transmission of oil prices to real exchange rates clearly varies over time, significantly increasing and reaching a peak in some countries (Canada, Indonesia, Norway) or decreasing in the United Kingdom. This period coincides with the increase in the non-OECD’s oil consumption share in the world consumption, stemming mainly from a rise in China’s and India’s oil consumption. The second period begins after the world trade collapse, where the sensibility of real exchange rates is broadly maintained at a constant level. Differences in the adjustment pattern between those two periods and within each period underline the fact that the relationship between the oil price and real exchange rates is subject to change over time, suggesting that time-varying effects are a key issue when analyzing oil currencies. Moreover, as reactions of real exchange rates to the real oil price are more fluctuating during the first period which coincides with the increase in the non-OECD’s oil consumption, we should therefore expect to obtain more significant impulse responses when increases in oil prices are driven by a growing global demand. This confirms the relevance to investigate the origins of this time-varying dimension of the relationship between real exchange rates and the oil price, by distinguishing the underlying sources of oil price shocks.

Specifically, we show in our analysis [1] that while oil supply shocks play a small role in explaining the relationship between oil prices and real exchange rates, oil demand shocks are shown to have a sizeable effect, over the 1988-2003 period. Indeed, those shocks cause time-varying relationships between real exchange rates and oil prices which, however, tend to offset each other. However, the appreciation of real exchanges rates following a demand-driven rise in oil prices is only confined to some countries, suggesting that in addition to endogenous structural changes in the oil market, both economic policies and structural characteristics matter as driving forces behind the adjustment of real exchanges rates to oil price shocks.

[1] Allegret Jean-Pierre, Couharde Cécile, Mignon Valérie, Razafindrabe Tovonony (2015), “Oil currencies in the face of oil shocks: What can be learned from time-varying specifications?”, Working Paper CEPII.

< Back