La 14e édition du Printemps de l'économie dont le thème principal sera "Le temps des rapports de force" aura lieu les 17-20 mars 2026 au CESE à Paris. Prenez part aux tables rondes, en présentiel ou à distance, avec la participation des économistes du CEPII:

Quel avenir pour l’Europe dans un monde de rapports de force ? 17 mars 2026Vers quel monde nous conduit Trump ? 17 mars 2026 Nouvelle mondialisation, nouveau bloc social dominant ? 20 mars 2026 >>> |

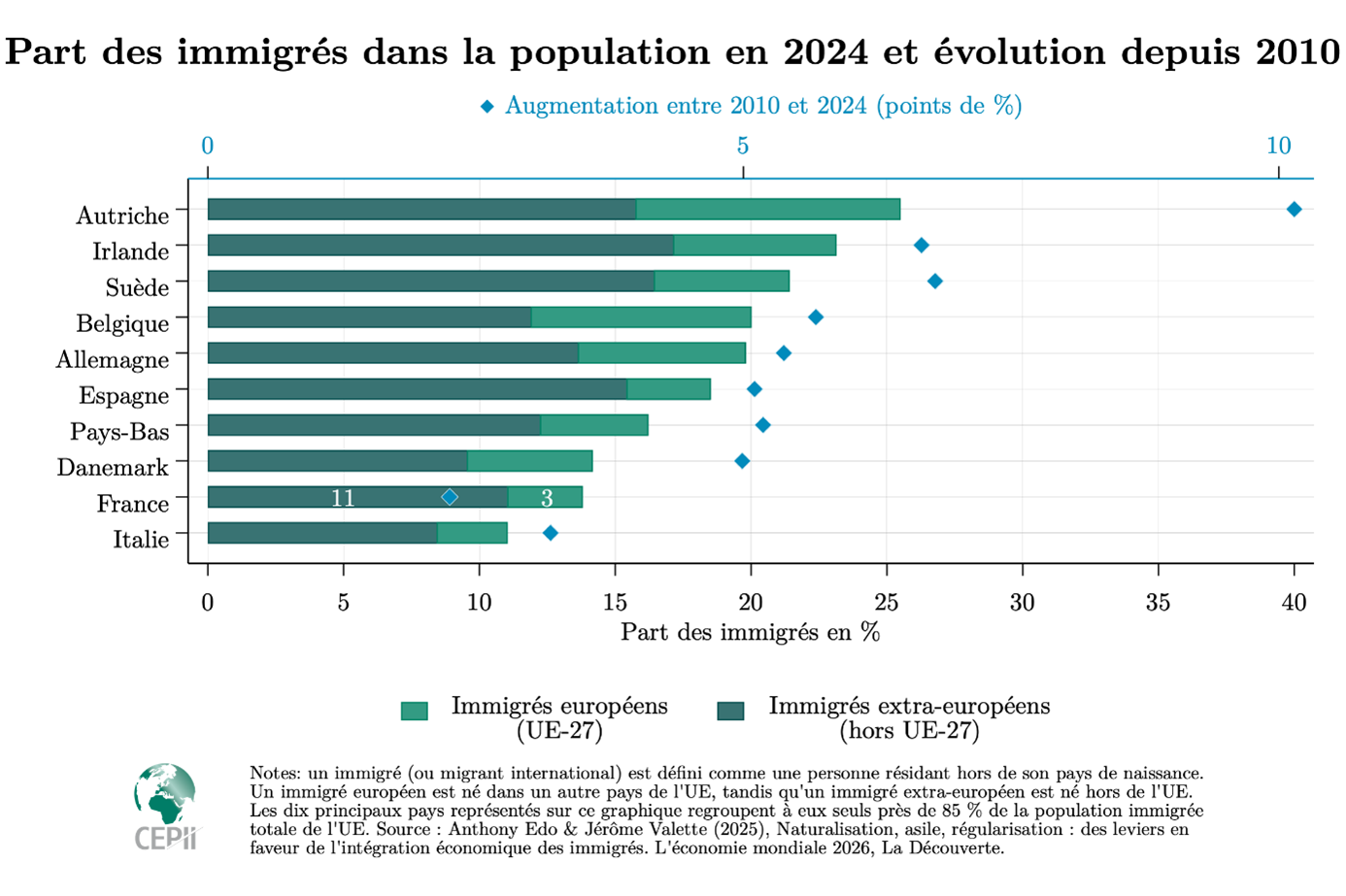

- Part des immigrés en France : un niveau et une progression inférieurs à ceux des principaux pays d’accueil européens

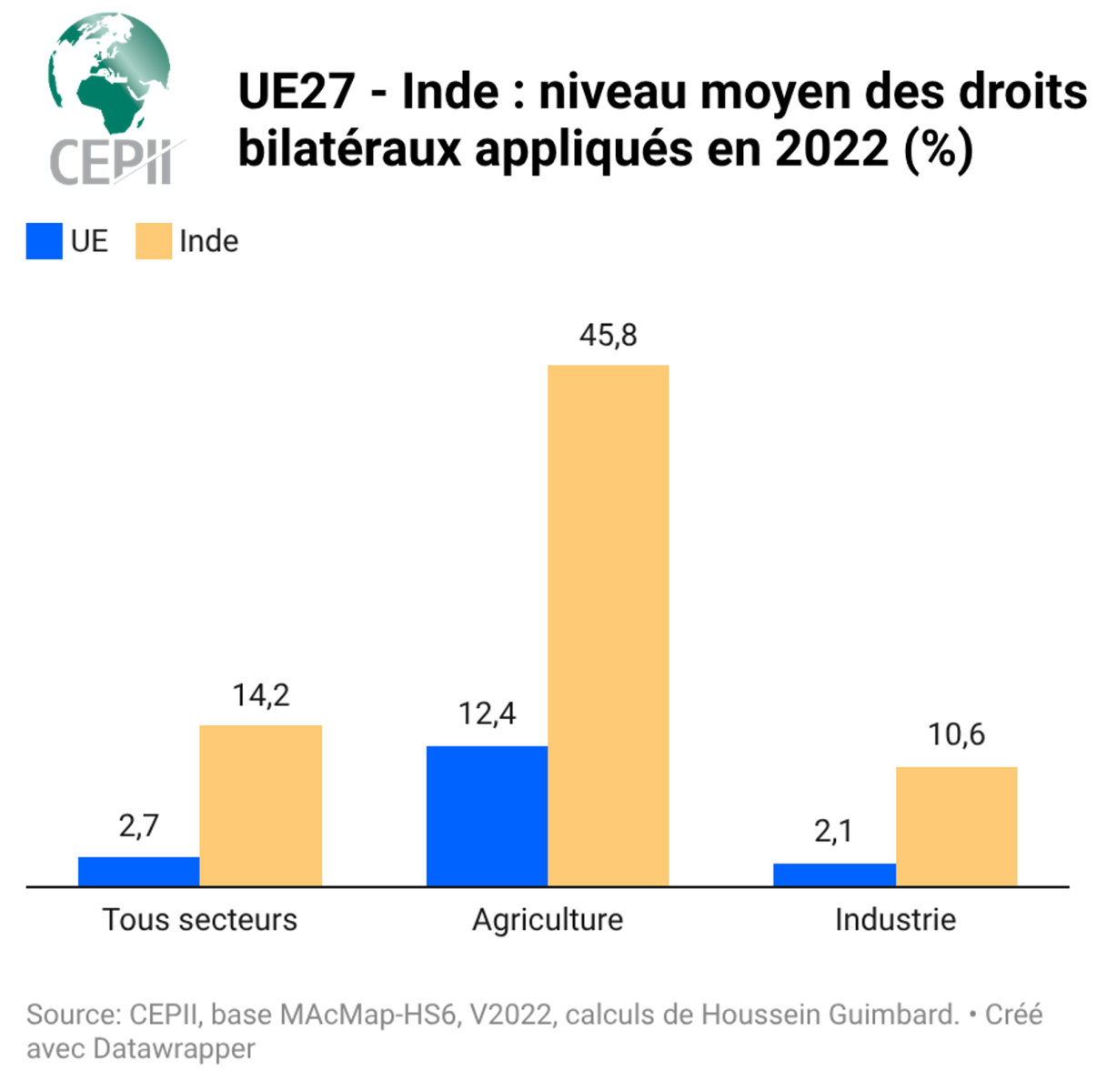

Anthony Edo, Jérôme Valette - Accord de libre-échange indo-européen : de nouveaux débouchés pour les produits européens

Houssein Guimbard

- Conférence de Citéco " Qui gouverne le climat ? "

Podcast vidéo

Christophe Gouel - Groenland, guerre commerciale : l'Europe face à Trump

Podcast vidéo

Vincent Vicard - Le "bazooka économique", l'Europe prête à riposter ?

Podcast vidéo

Thomas Grjebine - Droits de douane américains : qui sont les gagnants et les perdants ?

Podcast audio

Isabelle Méjean - Les sanctions économiques contre la Russie sont-elles vraiment efficaces ?

Podcast vidéo

Kevin Lefebvre

Le CEPII, partenaire de la Cité de l'économie. Table ronde "Cinéma, mode, jeux vidéo : la culture, super-pouvoir mondial"

14 mars 2026

Quel avenir pour l’Europe dans un monde de rapports de force ?

Le CEPII au Printemps de l'économie 2026

17 mars 2026

Vers quel monde nous conduit Trump ?

Le CEPII au Printemps de l'économie 2026

17 mars 2026

Nouvelle mondialisation, nouveau bloc social dominant ?

Le CEPII au Printemps de l'économie 2026

20 mars 2026

7th EMME Workshop Emerging Market MacroEconomics

20 mars 2026

Discussion avec Romain Duval (FMI) "The investment and broader macroeconomic impacts of the EU’s energy transition"

25 mars 2026

Présentation de l'ouvrage annuel du CEPII "L'économie mondiale 2027"

9 septembre 2026

- Les Echos

S'attaquer enfin au problème des métaux rares

Valérie Mignon - GeopoWeb

Métaux critiques. Étaux critiques: nouvelles lignes de fracture de la puissance mondiale. Dépendances stratégiques, rivalités sino-américaines et dilemme européen

Carl Grekou, Emmanuel Hache, Valérie Mignon - Libération

Les «stablecoins», monnaies privées promues par Trump, représentent une infime fraction des capitaux en circulation

Éric Monnet - Alternatives économiques

Les stratégies des multinationales pour échapper au fisc français

Vincent Vicard - Alternatives économiques

Un nouveau choc chinois arrive mais pas celui qu’on attend

Vincent Vicard - Public Sénat

Réindustrialisation : « L’immigration probablement indispensable » selon le patron de BPI France

CEPII - Le Journal de l’Economie (Radio Classique)

Impacts de l'immigration sur le marché du travail

Anthony Edo, Hillel Rapoport - BFM TV

Immigration: gare aux idées reçues sur le travail

Anthony Edo, Hillel Rapoport - Libération

L’immigration n’a pas d’effet causal sur le niveau moyen de délinquance

Jérôme Valette - Le Figaro

Travailleurs immigrés : des effets discutés sur le marché du travail

Anthony Edo, Hillel Rapoport - L'Express

Immigration et marché du travail : cette étude qui tord les idées reçues

Anthony Edo, Hillel Rapoport - France Inter

Deux économistes montrent que l'impact de l'immigration est neutre sur le marché du travail en France

Anthony Edo, Hillel Rapoport - La Tribune

Non, l’immigration ne fait pas baisser l’emploi et le salaire des Français

Anthony Edo, Hillel Rapoport - c'est toute la question (Francetv Info)

Face au « rouleau-compresseur chinois », quel avenir industriel pour l’Europe ?

Thomas Grjebine - BFM Business

Avantage productif chinois : « quatre fois plus vite, quatre fois moins cher ». Pourquoi le Haut-Commissariat au Plan préconise des droits de douane à 30 % ou une forte dépréciation de l’euro

Thomas Grjebine - Libération

Guerre commerciale : Clément Beaune veut 30% de droits de douane face au «rouleau compresseur chinois»

Thomas Grjebine - Les Echos

Les propositions chocs du commissariat au Plan pour sauver l'industrie européenne « face au rouleau compresseur chinois »

Thomas Grjebine - Le Monde

Le Haut-Commissariat à la stratégie et au plan propose un droit de douane européen global de 30 % face au « rouleau compresseur chinois

Thomas Grjebine - Le Figaro

Le déficit commercial recule, à 69 milliards d’euros, surtout grâce à l’énergie

Thomas Grjebine - L'Humanité

L’Europe peut-elle stopper Donald Trump ?

Vincent Vicard - wansquare.com

La diversification n’est pas la recette miracle pour exporter

CEPII - Sur le terrain (France Info)

Les Français, moins riches que la moyenne européenne

Thomas Grjebine - Atlantico

La soumission tranquille du Canada et de certains Européens à la Chine

Thomas Grjebine - Le Figaro

«C’est un indicateur des malheurs du monde» : comment les décisions de Donald Trump bouleversent le cours de l’or

Jérôme Héricourt - Challenges

Non, l’immigration n’abaisse pas les salaires et l’emploi : cette étude qui casse les idées reçues sur ce sujet explosif

Anthony Edo, Hillel Rapoport - Les Echos

Emplois, salaires : l'étude qui casse les idées reçues sur les effets de l'immigration

Anthony Edo, Hillel Rapoport - Le Figaro

Pourquoi le coût du travail reste encore trop élevé en France

Thomas Grjebine - AFP

Commerce international: lassés des caprices de Trump, les occidentaux se tournent vers l'Asie

Vincent Vicard - Alternatives économiques

L’économie russe pourra-t-elle survivre à une éventuelle paix ?

CEPII - L'Yonne républicaine

Face à la Chine : "En cas d’escalade de la guerre commerciale, les Européens seraient encore plus fragilisés"

Thomas Grjebine, Vincent Vicard - Le Figaro

Pourquoi les milliards d’euros dépensés dans le logement donnent-ils de si piètres résultats ?

Thomas Grjebine - The Conversation

Entre immigration et marché du travail, des liens plus complexes qu’il n’y paraît

Anthony Edo - Public Sénat

Revirement de Donald Trump sur les droits de douane : quelle crédibilité pour la stratégie américaine ?

Thomas Grjebine - Le Nouvel Observateur

Politique monétaire de la BCE : il est temps de changer de siècle

Jérôme Héricourt - Marianne

Automobile, chimie… Voici où se trouvent les centaines de milliers d'emplois menacés par la Chine

Thomas Grjebine - EURadio

Face au "rouleau compresseur chinois", l'industrie européenne sur la voie du protectionnisme ?

Thomas Grjebine - Alternatives économiques

L’économie russe pourra-t-elle survivre à une éventuelle paix ?

CEPII - BFM Business

Plus de 20 ans après les États-Unis, l'Allemagne subit son propre "choc chinois": sous pression, le chancelier Friedrich Merz se rend en Chine alors que l'industrie allemande vacille

Thomas Grjebine - Public Sénat

Guerre commerciale : « Donald Trump a perdu un pouvoir discrétionnaire d’augmentation des droits de douane »

Vincent Vicard - Le Point

La décision de la Cour suprême contre Trump est une excellente nouvelle pour le reste du monde

Antoine Bouët - Le Monde

Si l’UE impose des droits de douane sur les importations chinoises, comment reprocher aux Etats-Unis de faire de même avec nous ?

Antoine Bouët, Isabelle Méjean, Vincent Vicard - Les Echos

Les sanctions économiques contre la Russie sont-elles vraiment efficaces ?

Charlotte Emlinger, Kevin Lefebvre - LE 5 A 7 (France Inter)

L’annulation des droits de douane américains par la Cour Suprême des Etats-Unis

Isabelle Méjean

Les sanctions économiques contre la Russie sont-elles vraiment efficaces ?

Quatre ans après le début de la guerre en Ukraine, l'économie russe s'érode. Est-ce imputable aux sanctions occidentales ? Explications en vidéo réalisée par Les Echos. Kevin Lefebvre et Charlotte Emlinger ont montré que le contournement des sanctions coûte cher à la Russie. « La majorité des pays qui sanctionnent et qui ne sanctionnent pas ont augmenté leurs prix en général vers la Russie à partir de 2022 comparé à d'autres destinations », explique Kevin Lefebvre. >>> |

>>> |

Accord de libre-échange indo-européen : de nouveaux débouchés pour les produits européens  Les droits de douane sont au centre de l’accord commercial conclu entre l’Union européenne (UE) et l’Inde fin janvier. Les exportateurs européens ont désormais une réelle opportunité de se positionner sur cet immense marché. Houssein Guimbard >>> |

Part des immigrés en France : un niveau et une progression inférieurs à ceux des principaux pays d’accueil européens La part des immigrés dans la population de l'Union européenne a augmenté entre 2010 et 2024, mais à des rythmes très différents selon les pays. Anthony Edo, Jérôme Valette >>> |

| Si l’UE impose des droits de douane sur les importations chinoises, comment reprocher aux États-Unis de faire de même avec nous ? Imposer 30 % de taxes sur les produits en provenance de Pékin serait contreproductif pour doper notre autonomie stratégique, estiment, dans une tribune au « Monde », Antoine Bouët, Elvire Fabry, Xavier Jaravel, Thierry Mayer, Isabelle Méjean et Vincent Vicard.

>>> |

| S'attaquer enfin au problème des métaux rares Dans un monde marqué par la transition énergétique et la fragmentation géopolitique, l'Europe devra choisir entre des coûts immédiats pour sécuriser son approvisionnement en métaux rares ou des coûts différés en cas de pénurie, explique Valérie Mignon dans la chronique dans "Les Echos".

>>> |

| Un nouveau choc chinois arrive mais pas celui qu’on attend Au moment où l’inquiétude monte sur la capacité de l’Europe à faire face à la vague industrielle chinoise, il faut regarder les chiffres de près. La Chine pourrait-elle bientôt représenter 40 % de la valeur ajoutée manufacturière mondiale, contre près de 30 % aujourd’hui ? Tribune de Vincent Vicard dans les "Alternatives économiques"

>>> |

>>> |

Face à l'urgence climatique, une question s'impose : qui décide vraiment ? Cette conférence interroge les mécanismes de gouvernance mondiale du climat, entre institutions internationales, souverainetés nationales et instruments économiques.ntervenants:

Christophe Gouel, directeur de recherche à INRAE, Paris-Saclay Applied Economics et conseiller scientifique au CEPII. Christophe Cassen, ingénieur de recherche au CNRS, directeur adjoint au CIRED. Laurent Mauriac, cofondateur et directeur de la rédaction de Brief.eco >>> |

- Nous contacter

- Nos autres sites

ISSN: 1255-7072

Directeur de publication : Antoine BouëtRédacteur en chef : Evgenia Korotkova