The fixed exchange rate regime exacerbates deindustrialization

Premature deindustrialization in most emerging and developing economies has been one of the defining trends of recent decades. The adoption of a fixed exchange regime by low-productivity countries particularly accelerates this phenomenon.

By Carl Grekou, Valérie Mignon

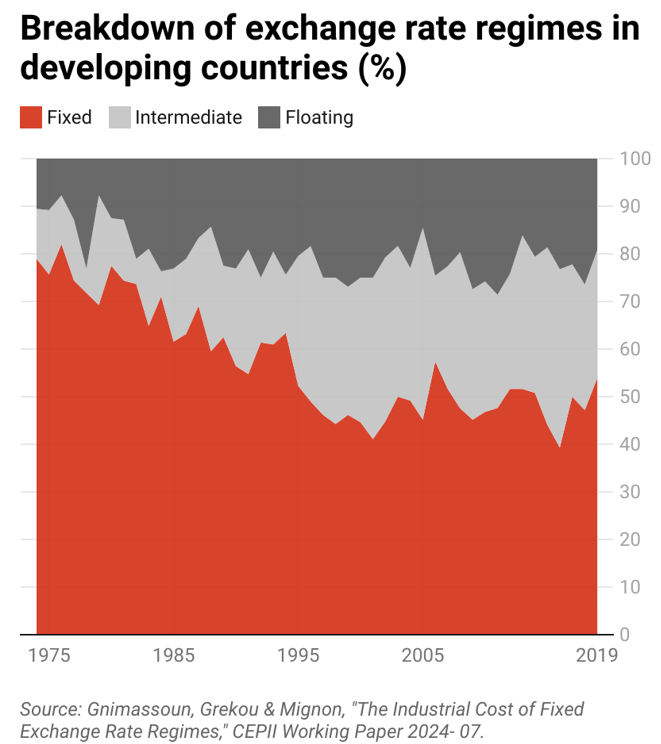

The exchange rate regime adopted by an economy affects the evolution of the size of its manufacturing sector. An analysis covering 146 countries over the period 1974–2019 shows that fixed exchange rates significantly contribute to reducing the size of the manufacturing sector. Developing countries are the most affected by the industrial cost of such a regime.

Trade appears to be a key transmission channel. In developing countries with relatively low productivity, a fixed exchange regime maintains structural dependence on manufactured imports, to the detriment of the emergence of local industry. Although the adoption of such regimes has declined significantly since the 1970s, fixed exchange rates are still in effect in more than half of developing countries today.

To find out more, read The Industrial Cost of Fixed Exchange Rate Regimes and Régime de change fixe : une entrave à l’essor industriel des pays en développement.

Trade appears to be a key transmission channel. In developing countries with relatively low productivity, a fixed exchange regime maintains structural dependence on manufactured imports, to the detriment of the emergence of local industry. Although the adoption of such regimes has declined significantly since the 1970s, fixed exchange rates are still in effect in more than half of developing countries today.

To find out more, read The Industrial Cost of Fixed Exchange Rate Regimes and Régime de change fixe : une entrave à l’essor industriel des pays en développement.

< Back