|

|

|

|

|

|

|

|

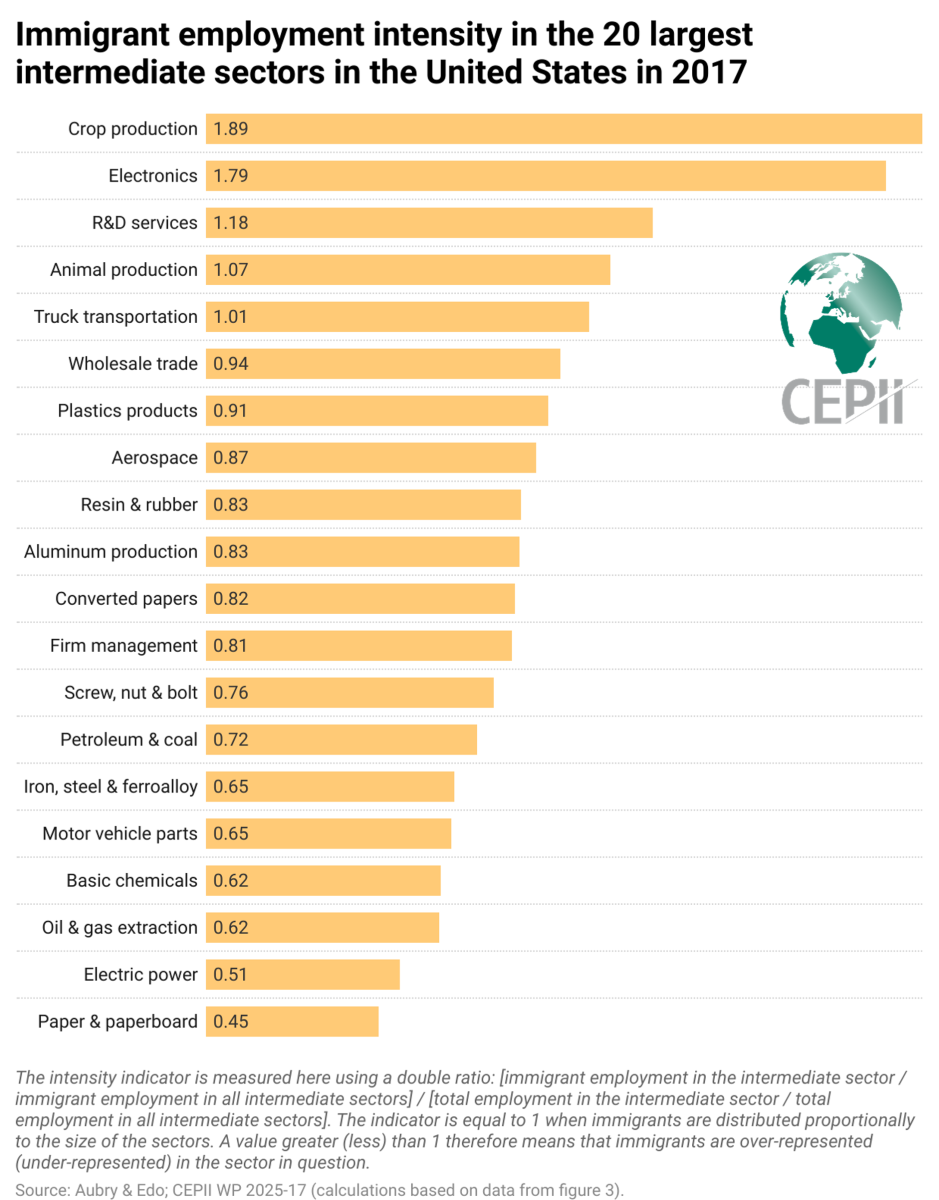

LE Graphique – THE ChartImmigrant Employment in Intermediate Sectors Enhances Downstream Export Performance

A sector’s export performance depends not only on the immigrant labour it employs directly, but also on immigrant workers employed in upstream sectors. Read more on the blog

|

|

Analysis and debatesThis Working Paper investigates the effect of anti-immigration attitudes on immigration plans to Europe. The authors propose a new instrument for attitudes toward immigration, namely, the number of country nationals killed in terrorist attacks taking place outside of Europe. The first-stage results confirm that such terrorist attacks increase negative attitudes to immigration in the origin country of the victims. The second-stage results then show that this higher hostility toward migrants decreases the attractiveness of the country for prospective immigrants. Continue reading >>

|

Coming Events

Le CEPII, partenaire de la Cité de l'économie. Table ronde "Qui gouverne le climat ?"

February 7, 2026

February 7, 2026

Le CEPII, partenaire de la Cité de l'économie. Table ronde "Cinéma, mode, jeux vidéo : la culture, super-pouvoir mondial"

March 14, 2026

March 14, 2026

See all

Past Events

Le CEPII, partenaire de la Cité de l'économie. Table ronde "Migrations internationales : rien que la vérité !"

January 10, 2026

January 10, 2026

Séminaire de recherche du CEPII : "When Neighbors Stop Knocking: The Impact of Canada's 2025 Tourism Decline on U.S. Local Businesses"

December 18, 2025

December 18, 2025

Spending Smarter: How Efficient and Well-Allocated Public Spending Can Boost Economic Growth

December 17, 2025

December 17, 2025

See all